Admissions

Ilma University Karachi Admission 2024 Last Date

by Aleena

Till now, Ilma University does not open admission to any single campus. When it opens…

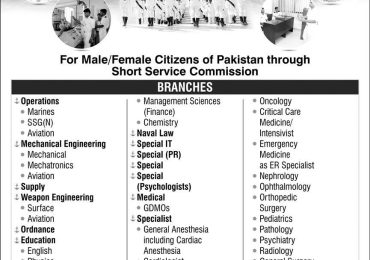

Jobs & Career

Join Pakistan Navy As Doctor 2024

by Aleena

People looking to Join Pakistan Navy As Doctor 2024 registration has not started till now…