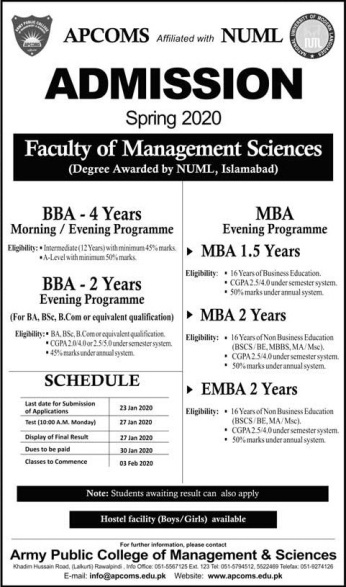

The latest news is here that APCOMS Spring Admissions 2025 is open now. The admissions are open for BBA, MBA, and EMBA programs. So all those students who are interested to be a part of this well-managed and well-named educational body are suggested and advised to read this entire post carefully and submit the admission form according to the instructions written here in this post. Army Public School of Management and Sciences is a military school in Rawalpindi that offers admissions from secondary-level classes to master-level programs. It provides a degree that is recognized by the Higher Education Commission HEC and Approved by the Ministry of Education Government of Pakistan. Students who hold master’s or bachelor’s degrees from this university get more preference to join Pak Army as an officer, engineer, or any other position. So if you are also interested to build your healthy educational career then keep reading this post below.

APCOMS Spring Admissions 2025

APCOM institute has yet not announced admission for new sessions and candidates will wait more days. Moreover, this school is considered a top-level school that provides quality education in a good environment. They give admission on a merit basis because they announce admission on limited seats. So, thousand of candidates submit the admission and appear in the test. Then management takes an interview on this behalf they allow admission.

APCOMS Admissions 2025 Schedule

| Event | Date |

| Last date to submit applications | Update Soon |

| Admission Test | Update Soon |

| Final Result | Update Soon |

| Submission of dues | Update Soon |

| Commencement of Classes | Update Soon |

APCOMS Eligibility Criteria

- The candidates with at least 50% marks under the annual system or 2.5/4.00 CGPA in 16 years of Non-Business education are eligible for an MBA for 2 yrs and an EMBA for 2 yrs and those candidates with the same marks or CGPA in 16 Years of Business education for are eligible for admission in MBA 1.5 Years.

- The candidates with at least 45% marks in Intermediate or 50% marks in A-Level are eligible for BBA 4 Yrs.

- The candidates with at least 2.0/4.0 or 2.5/5.0 CGPA or at least 45% marks in the annual system in BA, BSc, BCOM, or equivalent are eligible for admission in BBA 2 yrs.

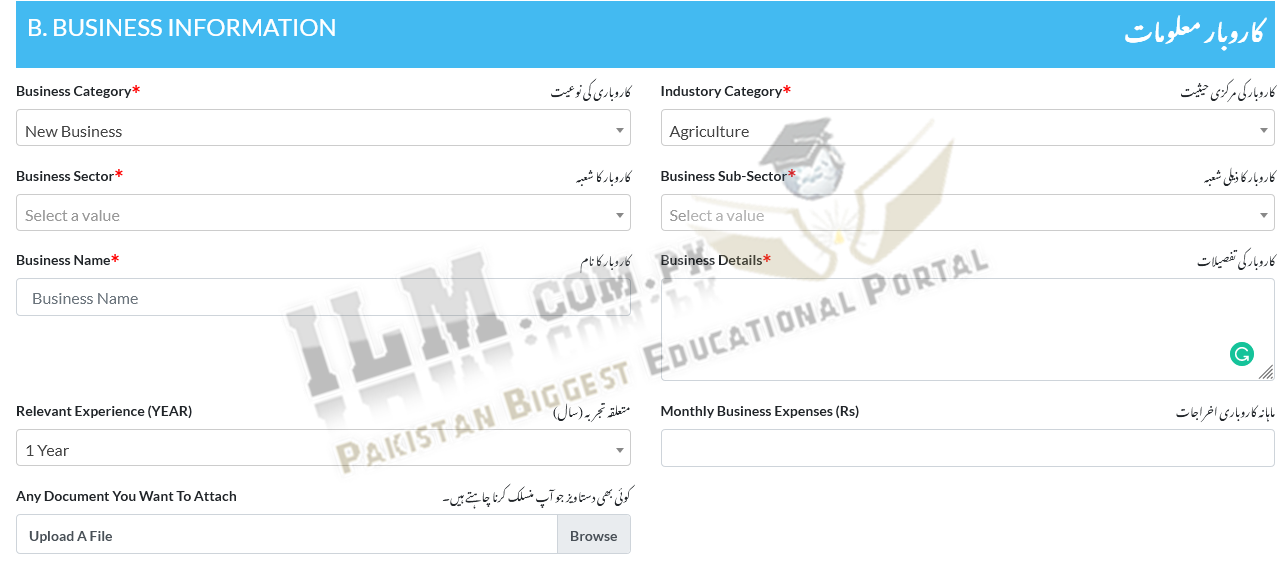

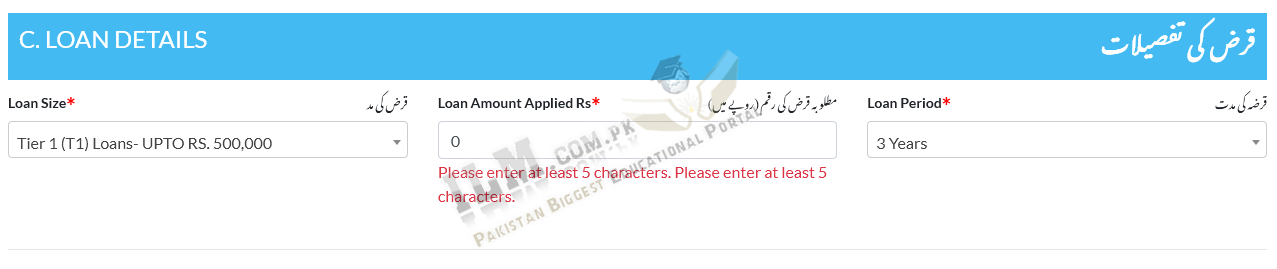

APCOMS Spring Admission Form

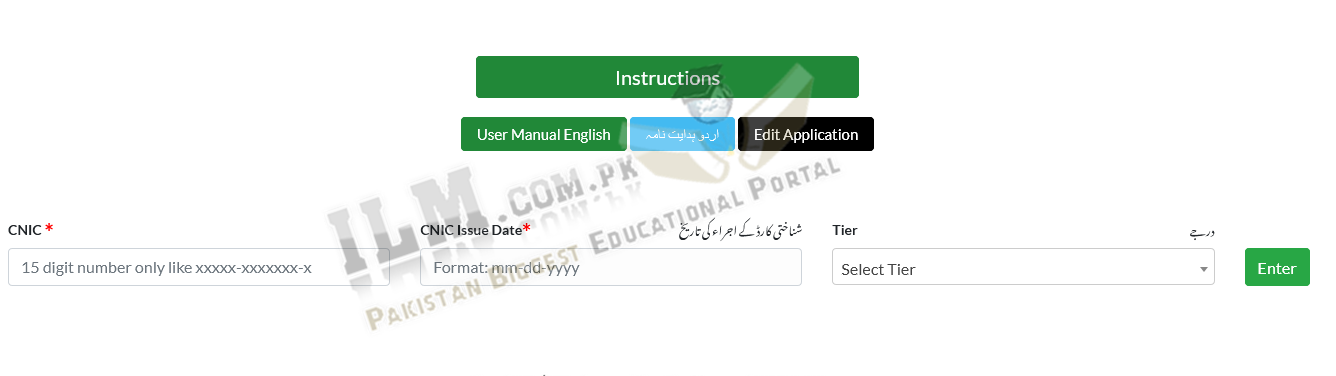

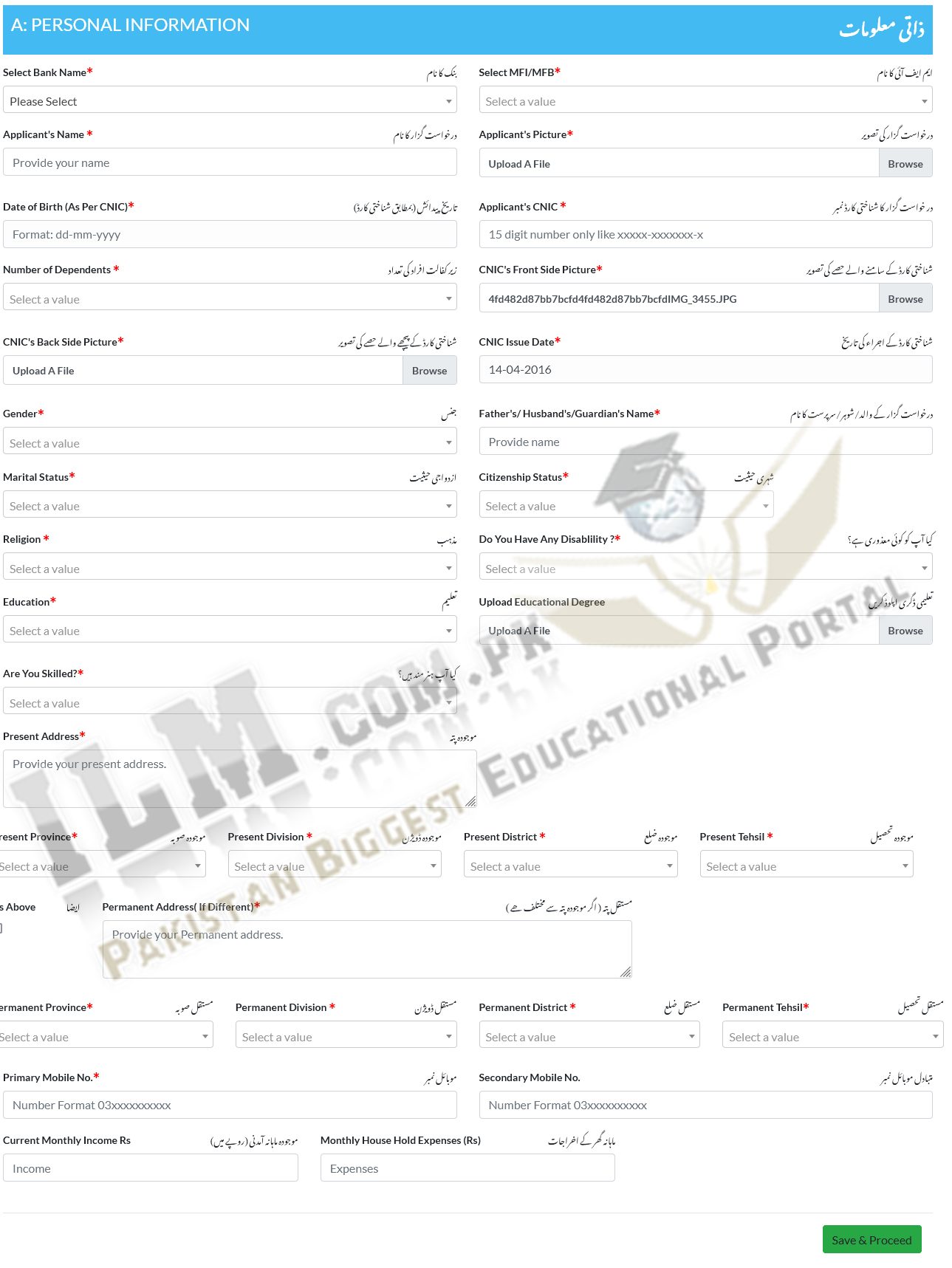

- If you are eligible for Admission, then, first of all, click the above-given option.

- Signup by providing a valid email address and the admission form will be on the front.

- Now fill out the form completely and submit it before the last date.

- Incomplete or late applications will not be entertained.

Before taking admission you have to see if you are eligible for this admission or not according to the criteria written above. If you see that you are eligible for this admission then you have two options for taking admission. First, you can apply online by clicking on the link below. If you did understand the online procedure or the APCOMS is near to you then you can go to the college campus and there you will get an admission form which you have to fill in dully and attach all the required documents with it. After this resubmit this complete package of admission forms and your educational documents to the admission office before the last date which is written in the below schedule. So, this is all about the Army Public College of Management and Sciences APCOMS Spring Admissions 2025 Form Schedule and eligibility criteria. Hopefully, you are confident with the admissions 2025. If there is any issue, then you can ask in the comment section.