If you are looking for or searching for the Zakat Nisab 2026 Pakistan State Bank Cash Gold then you are on the right page. Here you can get the information related to this, which is very helpful for you. The amount of Zakat can be calculated on the wealth that you have retained for one lunar year. According to Islam, 2.5% of that wealth would be the Zakat Nisab, and you have to contribute it to the needy. The percentage of Zakat is Universal all over the world. The Zakat is not only payable on Gold, Silver, or Cash, which is a perception of every mind, but it is also payable on the business profit, your shares, or the Bonds you have. In our country, Pakistan, the 1st of Ramadan is a holiday for the Bank for customers but not for the employees because on that day the zakat is deducted from every single account according to the Zakat Nisab in Pakistan set by the State Bank of Pakistan SBP.

How Much Is Zakat Nisab 2026 Pakistan?

This year, the Zakat Nisab has not set till now by the State Bank of Pakistan. That means if your amount in the bank is less than the state bank decided then no Zakat would be deducted from your account, but if the amount is more than that, the Zakat is deducted automatically. Well, there are a large number of bank depositors in Pakistan who write to the bank to not deduct Zakat from their account as they prefer to do Charity to their close Relatives which has more importance than charity. Every year, billions of Rupees are collected from Banks all over Pakistan, including the banks in Azad Jammu Kashmir Gilgit Baltistan, and FATA Areas Too.

Zakat Nisab on Gold 2026

- When your wealth is more than the Zakat Nisab set by the State Bank then you are obliged to give Zakat to the needy.

- If you need Zakat Nisab on Gold, then the gold you have for more than one year and is 87.48 grams/7.5 Tola/3 ounces in weight, then you are liable to pay Zakat on that, or if you have 52.5 Tola/612.36 grams of Silver.

- The Current Rate of Gold is Rs 509,500, 24K per Tola so the formula to calculate Zakat is simple Gross Weight of Gold – Weight of Stones X Price of Gold X 2.5%.

Zakat Nisab on Cash 2026

As mentioned above in this article, Zakat Nisab on Cash 2026 is set by the State Bank of Pakistan. The rate increases as the rate of Gold increases. So, this was all about Zakat Nisab 2026 Pakistan State Bank Cash Gold. Hopefully, you are confident about the post. Stay with us for more educational news.

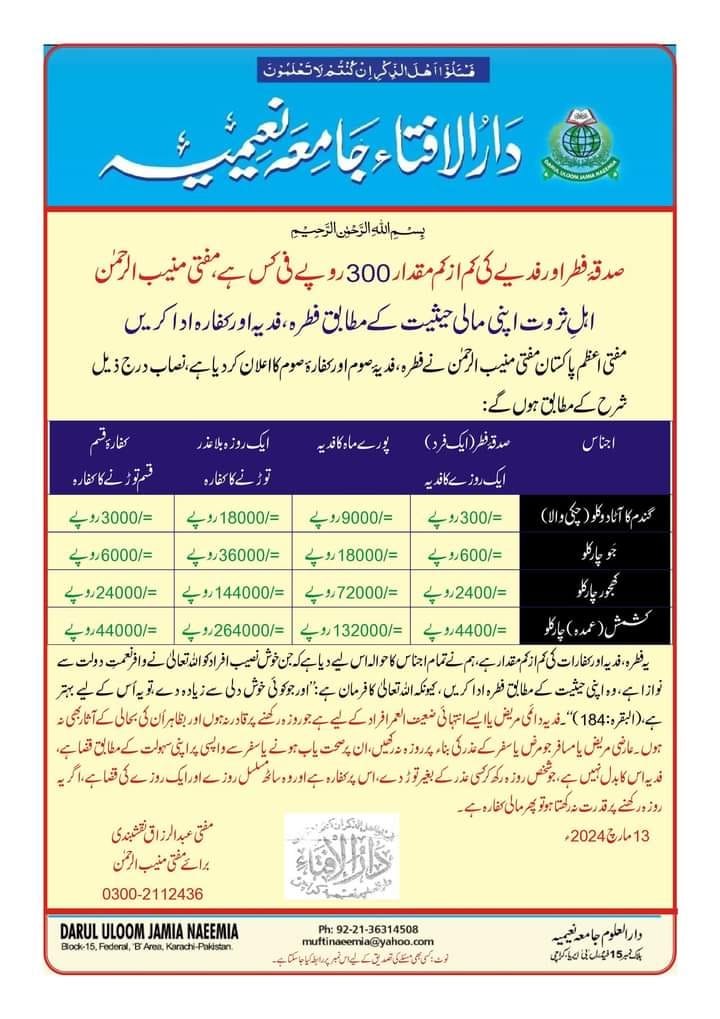

Fitrana 2026 Pakistan Price Per Person

| Item | Fidya Amount per Roza | Fidya Amount for 30 Fasts |

|---|---|---|

| Wheat | Rs300 | Rs9,000 |

| Barley | Rs600 | Rs18,000 |

| Dates | Rs2,400 | Rs72,000 |

| Raisins | Rs4,400 | Rs132,000 |

How to Calculate Zakat on Cash

Calculating Zakat on cash is straightforward:

- Determine total cash in hand, bank accounts, and other liquid assets.

- Subtract any debts or liabilities that must be paid.

- Compare net cash with Nisab threshold.

- If above Nisab, calculate 2.5% of the total as Zakat.

Example:

If your total cash savings are PKR 1,200,000 in 2026:

- Nisab (Gold) = PKR 880,000

- Zakat = 2.5% × 1,200,000 = PKR 30,000

How to Calculate Zakat on Gold and Silver

Gold and silver are also subject to Zakat if holdings exceed Nisab:

- Calculate total gold/silver in grams.

- Multiply by the current market price per gram.

- Compare with Nisab threshold.

- If above, pay 2.5% Zakat on total value.

Example:

- Gold held = 100 grams

- Market price = PKR 10,000/gram

- Total value = 100 × 10,000 = PKR 1,000,000

- Nisab = PKR 880,000

- Zakat = 2.5% × 1,000,000 = PKR 25,000

Zakat Payment Options in Pakistan

You can pay Zakat through multiple channels:

-

Direct donation to mosques or charitable organizations

-

Bank branches offering Zakat services

-

Online Zakat portals approved by the government or recognized NGOs

Paying Zakat promptly ensures your obligation is fulfilled and supports the welfare of the needy.

People who are finding the Fitrana rate now can get it from this page. Moreover, all the latest information about Zakat Nisab 2026 Pakistan State Bank Cash Gold is mentioned above, and people can read.